Veterans who have served our country with unwavering dedication and sacrifice deserve the utmost respect, support, and care. For those who have been awarded a 100% disability rating by the Department of Veterans Affairs (VA), a wide range of life-changing benefits becomes available.

These benefits are designed to help veterans and their families navigate the challenges that come with service-connected disabilities, ensuring they receive the assistance they need to lead fulfilling lives.

At VetsForever, we understand the complexities of the VA claims process and are committed to helping veterans access the benefits they’ve earned.

As a VA-accredited law group founded by 100% service-disabled veterans, we know firsthand the importance of securing these benefits, not just for the veterans themselves, but for their families and the entire veteran community.

In this blog post, we’ll explore the top 5 benefits of a 100% VA disability rating, showcasing how these resources can make a profound difference in the lives of veterans and their loved ones.

From healthcare and financial support to educational opportunities and beyond, these benefits serve as a testament to our nation’s commitment to those who have given so much in service to our country.

So, whether you’re a veteran seeking to understand your entitlements or a family member looking to support your loved one, join us as we delve into the life-altering benefits that come with a 100% disability rating. Together, we can ensure that our nation’s heroes receive the care, compensation, and support they deserve.

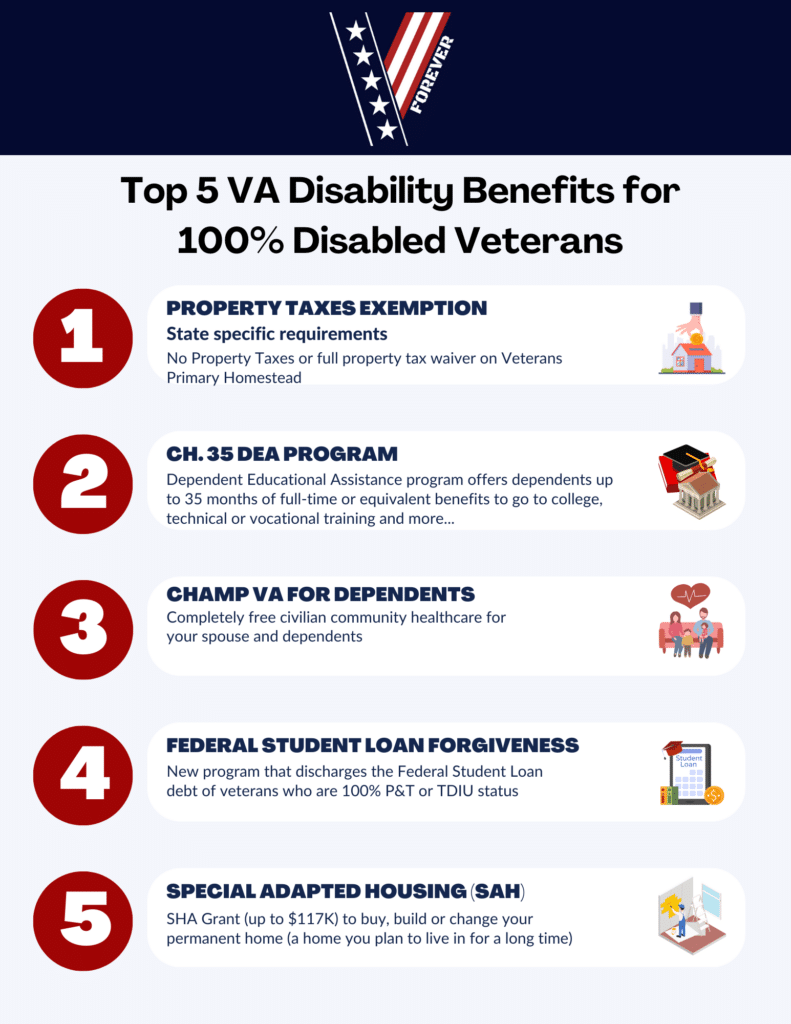

Property Tax Exemptions

Twenty states currently offer full property taxes exemptions for the veterans primary homestead. They include:

- Alaska

- Connecticut

- Florida

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Maine

- Massachusetts

- Michigan

- Nevada

- North Dakota

- Oregon

- Rhode Island

- Texas

- Utah

- Vermont

- Washington

- Wyoming

CH. 35 DEA Program

Chapter 35 Dependent Educational Assistance program offers the child or spouse of a Veteran or service member who has died, is captured or missing, or has disabilities, to get help paying for school or job training for up to 36 months of full-time or equivalent.

Children must be age 18-26 to get this benefit. In certain cases, it is possible to begin before age 18 and to continue after age 26. Getting married doesn’t end your eligibility.

You can’t get this benefit while on active duty. VA can extend your period of eligibility by the number of months and days equal to the time spent on active duty. This extension cannot go past your 31st birthday.

Remedial, deficiency and refresher courses may be approved under certain circumstances.

Spouse benefits end 10 years from the date VA finds you eligible or from the date of death of the veteran. However, if you are a surviving spouse of a service member who died on active duty, your benefits end 20 years from the date of death.

If you divorce the veteran, your benefits end on the date of divorce. If you remarry before age 57, your eligibility ends on the date of remarriage.

As of 10/1/2023, the rates are:

- Full Time: $1,488

- 3/4 Time: $1,176

- 1/2 Time: $812

- <1/2 but >1/4 Time: $862

- 1/4 Time: $372

Champ VA for Dependents

ChampVA is a health insurance program provided by the Department of Veterans Affairs to dependents. There are no premiums and no-cost coverage for the veteran.

However there are deductibles and co-pays associated with using this coverage. After an annual deductible of $50, the participant pays 25% of the covered amount.

Participating providers agree to accept 75% of the billed amount and this is called the covered amount. The covered amount is very similar to the way that Medicare pays doctors and hospitals.

Any provider that accepts Medicare has to accept ChampVA. Certain VA medical centers will also accept ChampVA participants. If the medical center does accept the insured, then the medical care is free except for prescription drug co-pays.

Federal Student Loan Forgiveness

If you are 100% P&T or TDIU then your Federal Student Loan debt will be discharged in full regardless how much you owe. This also applies to the TEACH Grant service obligation.

Special Adapted Housing (SAH)

The Department of Veterans Affairs (VA) provides grants to Servicemembers and Veterans with certain permanent and total service-connected disabilities to help purchase or construct an adapted home, or modify an existing home to accommodate a disability.

Two grant programs exist: the Specially Adapted Housing (SAH) grant and the Special Housing Adaptation (SHA) grant. Under either grant, a Temporary Residence Adaptation grant (TRA) may be available to Veterans who are/will be temporarily residing in a home owned by a family member.